Plootus 401k/403b Simplified app for iPhone and iPad

Developer: Analyze Future LLC

First release : 02 Dec 2017

App size: 21.16 Mb

Did you know, on average, an employee pays an extra $100k in hidden fees from their retirement accounts: 401k / 401(k), 403b / 403(b), 457, 401a, and Thrift Saving Plans (TSP)? Most of us make wrong investment choices or select target date funds without proper due diligence. We understand you do not have the time. No one wants to spend time on Retirement Planning, and that’s a big mistake! 401k or 401(k), 403b or 403(b), 457, 401a, and TSP plans are the most critical sources of retirement savings for most Americans.

Do it yourself or delegate it to an Advisor for FREE!

Let Plootus help you be ready for a Happy and Wealthy Retirement. We offer Premium investment advice for FREE. We do not promote any fund family such as Fidelity, Blackrock, Vanguard, PIMCO, TIAA, American Fund, or others. We select the best investment options that are good for you. The

Plootus app uses Artificial Intelligence (AI) to help you meet your retirement goals. Optimize your retirement plans such 401k / 401k or 401(k), 403b or 403(b), 457, 401a & Thrift Savings Plan (TSP).

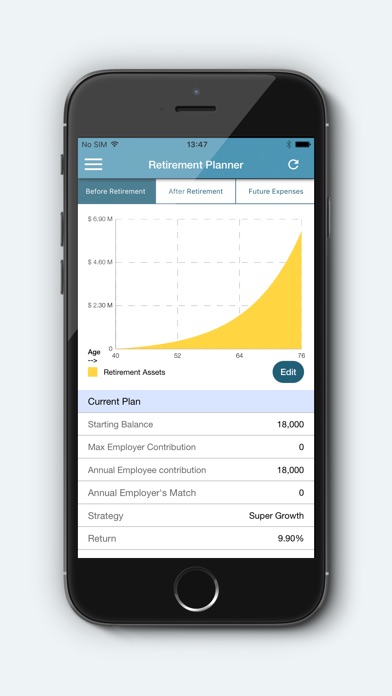

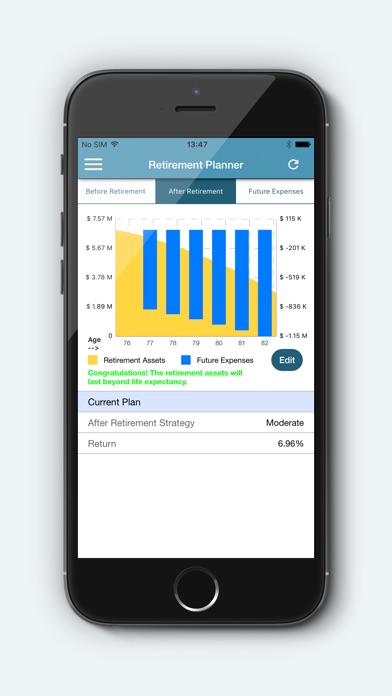

With Plootus you are in charge and can be your own financial advisor. Plootus provides a Retirement calculator and an Income calculator to assist you in calculating how much you need for retirement. It selects investments that are best in terms of performance and charges lower fees. Thus, making it fast and easy to allocate your investments in your 401k / 401(k), 403b / 403(b), 457, 401a, and TSP plans.

If you find it cumbersome and time-consuming to do it yourself, just delegate to a Financial Advisor of your choice through the app. We care for your retirement, that is why we are providing our services for FREE for a limited time!

Plootus has analyzed thousands of 401k / 401(k), 403b / 403(b), 457, 401a, or Thrift Savings Plan (TSP) plans offered by US employers. Some of the popular employer searches on Plootus.com and the Plootus App are Amazon, Alphabet (Google), Meta (Facebook), General Electric (GE), Nissan, Tesla, Avangrid, New York University, Fairfield University, University of Alabama, University of Michigan among others. Plootus is a one-stop-shop personal investment app where you enjoy premium services for FREE.

How does it work?

1. To find the best investment options amongst those offered by your employer-sponsored 401k / 401(k), 403b / 403(b), 457, 401a, and TSP plans, search your employer’s name, and you will get the investment allocation for your Risk or Investment Strategy (Super Growth, Growth, Moderate, Conservative or Super Conservative).

2. Next step is to log in to your employer-sponsored 401k / 401(k), 403b / 403(b), 457, 401a, and TSP plans and make an inter-fund transfer based on the investment allocation suggested by Plootus.

No one offers you this advice for FREE!

For a thorough analysis, link your financial accounts (bank, credit card, 401k / 401(k), 403b / 403(b), 457, 401a, and TSP plans) in a SECURE environment (SSL encryption) to understand your total Income and Expenses, Assets and Liabilities, and Net Worth.

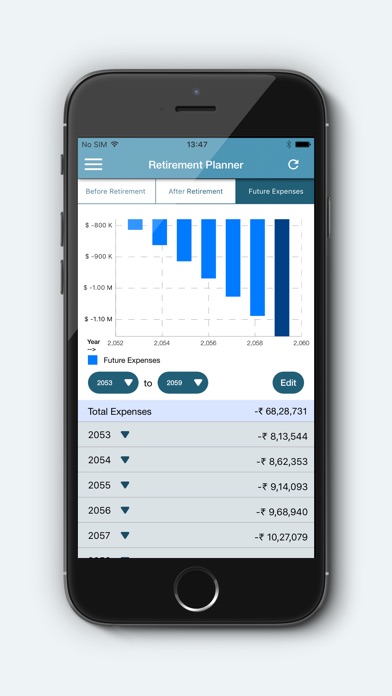

Our AI analyzes your spending habits and assists you in determining how much money you need for retirement based on your zip code. It takes the guesswork out. Plootus analyzes your spending pattern, life changes, and inflation, and determines how much you need to retire comfortably. We analyze 30+ expense categories, consider location and expected future expenses like healthcare, and provide a realistic picture of your retirement needs.

The best part is, we don’t ask you to update any information manually that other tools will ask you to do. Our AI provides you with answers with minimal input and offers flexibility to make edits.

Investors should consider their investment objectives and risks carefully before investing or making any changes to their investment options. Nothing in this communication should be construed as tax advice, a solicitation or offer, or recommendation, to buy/sell any security.